I see this is the job China is doing… If you want to monitor every transaction, you can only do this through a central bank digital currency… If you want to impose negative interest rates, you can do this through a central bank digital currency… If you want to directly tax citizens’ accounts, you can only do this through a central bank digital currency…

This was stated last August by Neel Kashkari, president of the Fed in Minneapolis (and former executive at Goldman and Pimco). How many great things can you do with a digital currency – is the move foolish?

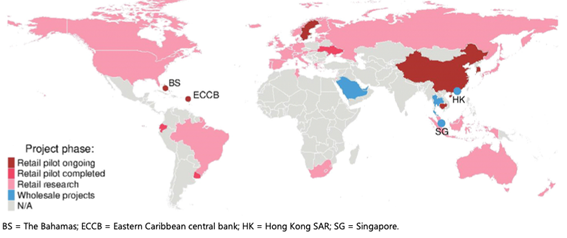

Since the beginning of last March, the American president has signed “Executive Order 14067” which defines the parameters of the digital dollar. And last September, the European Central Bank selected Amazon, the Spanish bank CaixaBank, the French Worldline, the Italian Nexi and the “European Payments Initiative” (a consortium of 31 major European banks and payment intermediaries) to develop the digital euro.

It will take some time, and in the meantime the digital yuan will have advanced its internationalization. An “emergency plan” will also be needed to force citizens to comply. Especially Central Europeans are largely negative towards a form of money that, they understand, will end even the remaining scraps of privacy and personal life.

Meanwhile, while these are being fixed, there are margins for “energy crises”. You see, even digital currencies need electricity… So nuclear energy must be restored quickly…