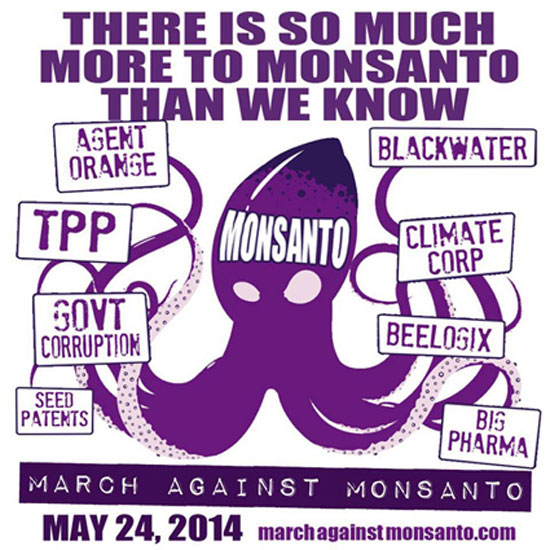

With the upcoming mega-merger between Bayer and Monsanto and the rise of digital agriculture and data-driven farming, our agricultural system is on the verge of a paradigm shift. According to a recent survey, 91.7% of farmers who participated in the research are concerned that Bayer-Monsanto will control the data relating to agricultural practices. Why are these farmers worried? Bayer and Monsanto can use proprietary data and intellectual property from seed and chemical substance patents and digital agricultural platforms to transform farmers from independent entrepreneurs into captive users.

Digital agriculture involves the mass collection of data on a farm through the use of sensors, ranging from pieces attached to agricultural machinery to satellites. This data is channeled through a platform to a service provider, such as Monsanto, whose algorithms then use the data either to display conditions on the farm or to make specific recommendations. Ultimately, the use of big data in agriculture concerns the creation of detailed prescriptions for sowing and the application of chemical substances.

Although theoretically there may be benefits for farmers from digital agricultural tools, the majority of current research and development focuses on uses for chemical-intensive monocultures. A new white paper from the Konkurrenz group reveals that Bayer-Monsanto will use the rise of digital agriculture to gain significant power. If the merger is completed, only four companies will dominate the market (DowDuPont, Syngenta-ChemChina, BASF and Bayer-Monsanto). According to the white paper, competition among the four large companies will “increase farmers’ dependence on the digital platforms of the four large companies, where based on the collected data, farmers will rely more (and not less) on the traits, seeds and pesticides of the four large companies for increasingly automated precision agriculture”.

The findings of the Konkurrenz group align with the report released by Friends of the Earth, the Institute for Open Markets, and SumOfUs in November, titled “Bayer-Monsanto Merger: Big Data, Big Agriculture, Big Problems Merger.” Farmers have already faced significant loss of bargaining power when purchasing agricultural inputs, such as seeds or pesticides. Recent mergers, acquisitions, and anti-competitive practices in the field of digital agriculture are only the most recent signs that this trend will continue.

The leading digital agriculture companies ensure they have access to more customers through partnerships with agricultural machinery companies. While Monsanto canceled the sale of Precision Planting to John Deere in 2017, the companies continue to have a profitable data agreement. In the same press release that signaled the termination of the sale, it is stated that Monsanto “has sold more than 10,000 Climate FieldView Drive devices that transmit real-time data from planting machines, sprayers and combine harvesters, with more than 70 percent of FieldView Drive data being transmitted today from John Deere’s planting machines and combine harvesters.”

Climate Corporation recently announced that it will create full connectivity between its data platform and New Holland agricultural machinery. Meanwhile, Syngenta has strongly promoted its participation in Ag Gateway, a consortium of groups trying to standardize the “language” of agricultural data to better facilitate exchange between devices and companies. The grouping of data platforms with agricultural machinery companies that have a large market share is an effective way to rapidly expand the reach of such products.

In recent months, some of the largest companies have implemented the first pieces of a fully integrated platform that includes both chemical substances and data services. For example, BASF’s Grow Smart Rewards program provides cashback to farmers when they purchase BASF pesticides to accompany the data platform. The system creates a very basic (but powerful) incentive for farmers to use certain products in combination with the company’s data analysis.

Monsanto was very open about its desire to increase the number of acres paid for Climate FieldView (Climate FieldView Plus) in the US. In 2017, Monsanto exceeded its target of 25 million acres, saying it has reached 35 million acres.

Retail seed dealers are now required to sell many more copies of FieldView Plus to receive a discount than in previous years. While the requirements for the discount are not publicly known, an article in CropLife identified some of the problems with the high discount requirements, including some retailers who may start to bundle the package with seed sales for free, in order to get their money back. This does not bother Monsanto, because the company gains more customers, while the retail seed dealer loses.

However, the pressure on retailers to aggressively promote FieldView Plus is only one piece of Monsanto’s strategy to gain dominance in digital agriculture. In August 2016, Monsanto announced its intention to create a “central and open data platform.” Monsanto wanted Climate FieldView to become the App Store of the industry. Independent digital agriculture companies could integrate their tools into the platform, where they would gain increased marketing capability, while Monsanto would take a financial share and access to all the data that would be collected. Monsanto also stated that it would make money from partnerships by selling some of this data within certain agreements. This is particularly concerning because it allows Monsanto to pick winners and losers among startups. It also ensures that Monsanto makes money from digital agriculture products without having to do any research and development. […]

This move clearly shows Monsanto’s desire to establish itself in the field of digital agriculture. Innovation in digital agriculture is moving very fast for any company to keep up. Instead, Monsanto has found a way to anchor innovation and control the direction of future research and development. If Monsanto can profit from operating the App Store of digital agriculture, it won’t need to significantly develop its own portfolio, in the same way that Apple doesn’t need to create apps to earn billions in profits. Moreover, Monsanto can gather its competitors on the same platform, where the company will profit regardless of which competitor farmers prefer. However, Monsanto does not allow competitors of its own digital products access to the platform.

The upcoming Bayer-Monsanto merger will create the most comprehensive portfolio of digital agriculture, seeds and chemical products in the world. Combined with Monsanto’s growing control over research and development for new digital agriculture companies, the era of competitive agricultural production data could quickly evaporate.

Digital agriculture has the potential to become a piece of a highly competitive sector. This is extremely important in a sector that has seen waves of mass consolidation over the past decades. But we are on the threshold of a digital arms race that could quickly see a handful of massive agrochemical giants dominate digital agricultural tools in the same way companies dominate the physical ones, such as seeds and pesticides. A merged Bayer-Monsanto would have great interest in controlling farmers’ information through a data-driven revolution to maximize profits. In a world where companies like Facebook are criticized by Congress for misusing personal data through a platform, there is no room for data concentration necessary to supply our food. […]

Published on the Friends of the Earth organization’s site on March 30, 2018. Read the original here: https://foe.org/blog/bayer-monsanto-digital-agriculture

Translation: Harry Tuttle